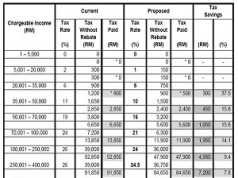

Income Tax Rates and Thresholds Annual Tax Rate. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than.

Malaysia Sst Sales And Service Tax A Complete Guide

Corporate - Taxes on corporate income.

. Malaysia Non-Residents Income Tax Tables in 2019. On the First 5000. Tax Booklet Income Tax.

Paid-up capital up to RM 25 million or less. Last reviewed - 13 June 2022. Historical Chart by prime ministers.

20182019 Malaysian Tax Booklet 7 Scope of. The Latest Labuan Tax 2019 changes effective from 1st January 2019 is as follows. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800.

Malaysia Non-Residents Income Tax Tables in 2019. Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other Duties Important Filing Furnishing Date. And simplified tax investment incentives that would be.

92019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Objective This Public Ruling PR provides an explanation on. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person.

Following table will give you an idea about corporate tax computation in Malaysia. A place of business as defined in Malaysia is also deemed derived from Malaysia wef the date the relevant law comes into effect. Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja.

Tax Rate of Company. Modal berbayar sehingga RM25. 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

6 December 2019 Page 1 of 19 1. For both resident and non-resident companies corporate income tax CIT is imposed on income. Tax Rate of Company.

Rate TaxRM A. 20182019 Malaysian Tax Booklet 22. 15 penalty on the tax payable for disclosures made from 1 April 2019 to 30 June 2019.

The standard Malaysia corporate tax rate is of 24 for the financial year of 2019-2020 this rate being applied to both resident companies and to non-resident companies. The flat tax fee of RM20000 is abolished for trading companies including all licensed entities. On the first RM 600000 chargeable income.

Income tax rates. The corporate tax rate for small and medium enterprises SMEs will be reduced to 17 this year from 18 previously.

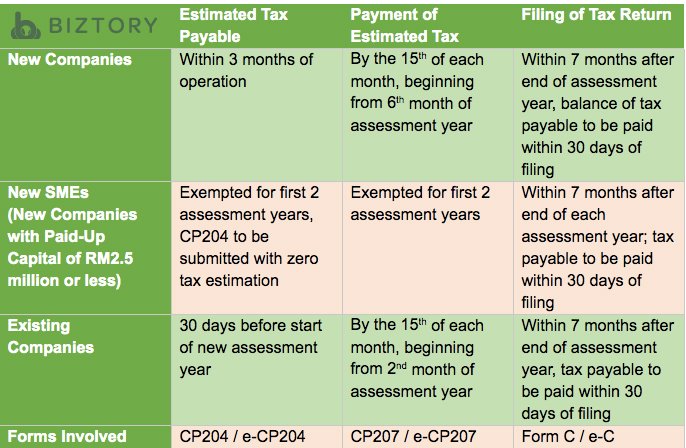

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Tax Revenue 1980 2022 Ceic Data

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

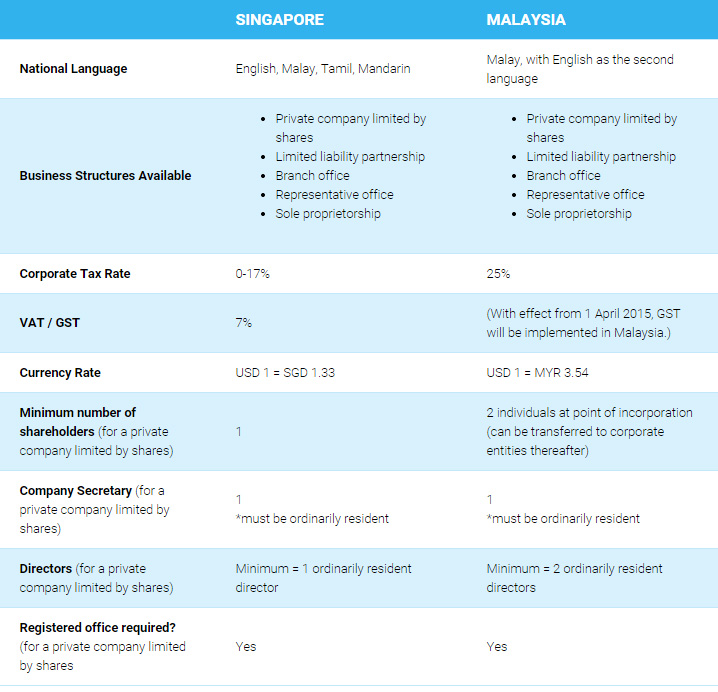

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Everything You Need To Know About Running Payroll In Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Income Tax Malaysia 2018 Mypf My

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Individual Income Tax In Malaysia For Expatriates

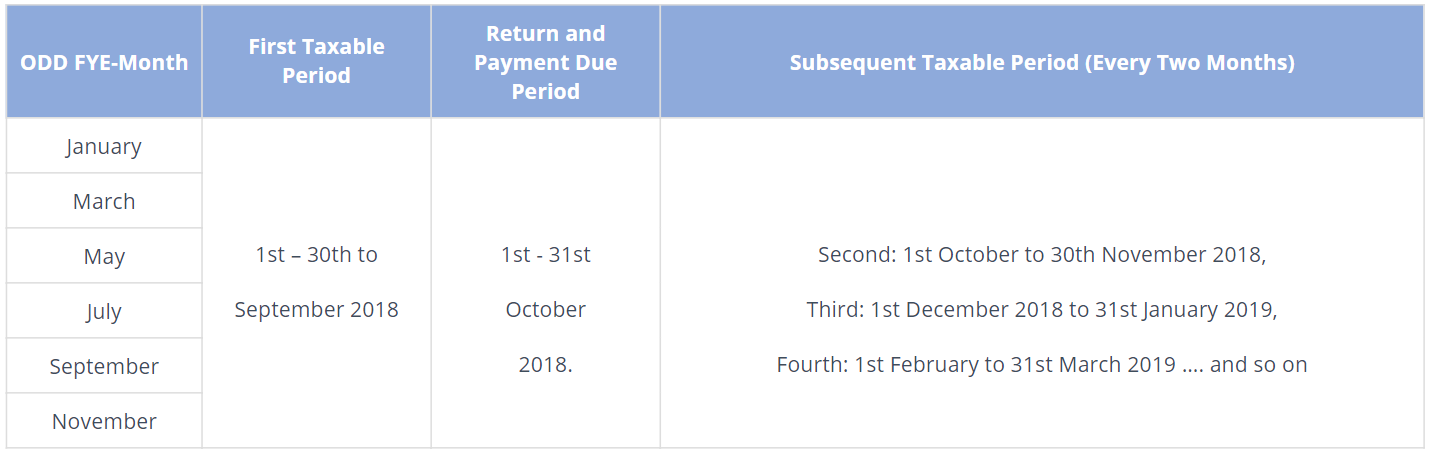

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Doing Business In The United States Federal Tax Issues Pwc

Gst In Malaysia Will It Return After Being Abolished In 2018

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia